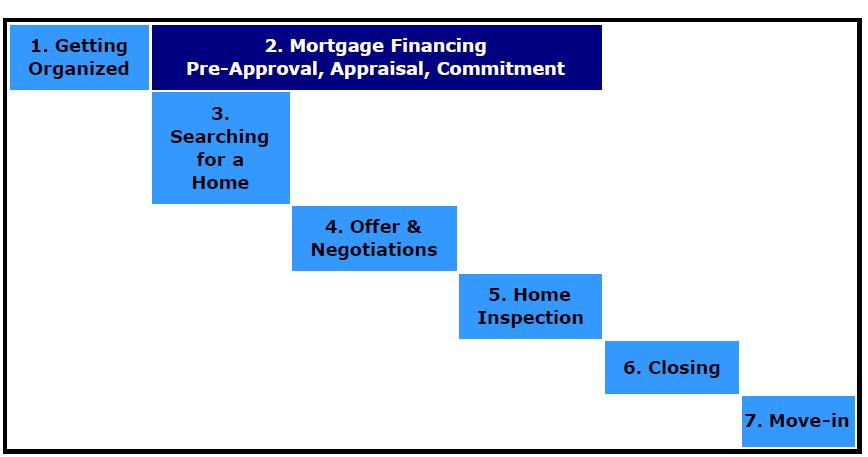

For competitive reasons when bidding on a property, we recommend you work out your financing options first - before you start to look at property.

For competitive reasons when bidding on a property, we recommend you work out your financing options first - before you start to look at property.

In New Jersey, your offer on a property must be in writing and with proof of your financing.

To assist you, we typically:

- Discuss:

- the differences between a financial pre-qualification and a more formal pre-approval.

- why you should get a mortgage pre-approval - before you look at homes. It:

- Gives you a loan amount for which you are qualified. (For an estimate how much you can afford to spend: Affordability Calculator.)

- Helps you better understand how much cash you may need available to purchase (closing costs, repairs, etc.).

- Makes you aware if the credit bureaus have erroneous or outdated information about you.

- Gives potential lenders the opportunity to advise you on the types of financing options available to you.

- Gives you comfort in knowing that your loan approval will not be an obstacle in the purchasing of your new home.

- Helps you eliminate from consideration homes that are not in your price range.

- Shows Sellers you are serious, and gives you a distinct advantage in negotiations. It’s the next best thing to offering ALL CASH.

- In the case of multiple offers on a desired property, your offer will stand out because your loan has already been pre-approved.

- Cuts the time needed to prepare for Closing by proving you can move more quickly than other Buyers.

- things to be aware of before talking with any lender (home mortgage payment affordability, condo maintenance or home owner association fees, down payment closing cash requirements, and property taxes).

- finding and working with mortgage lenders who are licensed in New Jersey, the typical steps involved, and the information you need to collect to make your mortgage application run smoothly.

- Clarify how we coordinate with your lender and the responsibilities of:

- you - the home buyer,

- your mortgage broker or lender,

- and us - your Exclusive Buyer Agent.

- and, finally, monitor the progress of your mortgage application, coordinate your property appraisal, and your final mortgage commitment.

[Back to Step 1] [To Next Step 3]